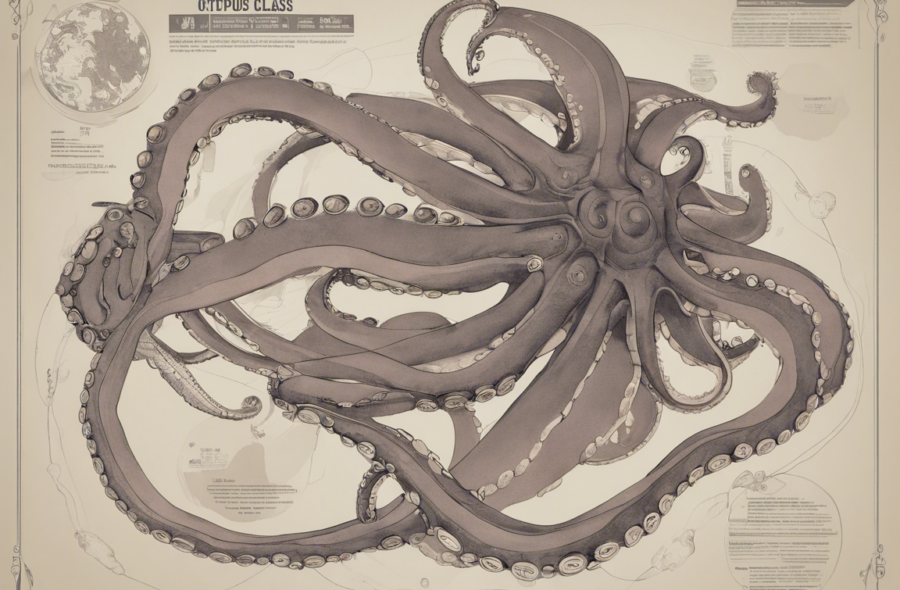

With the rise of different economic classes in modern society, one classification that has gained prominence is the Octopus Class Economy. This unique framework categorizes individuals based on their multiple streams of income, investments, and assets – resembling the tentacles of an octopus, reaching out in various directions. Understanding this concept is crucial for navigating the complexities of contemporary financial landscapes. In this article, we will delve into the intricacies of the Octopus Class Economy, exploring its benefits, challenges, and ways to effectively leverage its potential for financial success.

What is the Octopus Class Economy?

The Octopus Class Economy refers to a class structure where individuals have diversified their sources of income, investments, and assets across various sectors. Just like an octopus uses its eight tentacles to capture prey from different angles, individuals in this class have multiple streams of revenue and financial instruments to ensure stability and growth. This approach mitigates risks associated with relying on a single source of income or investment, providing greater resilience in volatile economic conditions.

Benefits of the Octopus Class Economy

-

Resilience: Diversification is key in the Octopus Class Economy, offering resilience against economic downturns or industry-specific challenges. If one source of income falters, others can provide a cushion, maintaining overall financial stability.

-

Income Multiplication: By having multiple streams of income, individuals can potentially increase their overall earning capacity. This approach allows for exponential growth compared to traditional single-income sources.

-

Risk Management: Spreading investments across diverse assets helps in managing risks effectively. While one investment may face fluctuations, others can counterbalance the impact, reducing overall volatility.

-

Opportunity Exploration: Being part of the Octopus Class Economy opens up opportunities to explore various investment avenues and income streams. Individuals can tap into emerging markets or industries, harnessing new sources of revenue.

Challenges of the Octopus Class Economy

-

Complexity: Managing multiple income sources and investments can be complex and time-consuming. Individuals must allocate resources efficiently to monitor and nurture each financial stream effectively.

-

Skill Requirement: Successfully navigating the Octopus Class Economy demands a diverse skill set, including financial acumen, market knowledge, and risk assessment capabilities. Continuous learning and adaptation are essential.

-

Balancing Act: Finding the right balance between diversification and concentration is crucial. Overextending into too many ventures can dilute focus and resources, while being too concentrated poses risks of vulnerability.

-

Tax Implications: With multiple income streams come various tax implications and compliance requirements. Individuals in the Octopus Class Economy must stay informed and seek professional advice to navigate tax regulations effectively.

Leveraging the Octopus Class Economy for Financial Success

To maximize the potential of the Octopus Class Economy, individuals can adopt several strategies:

- Strategic Diversification: Allocate resources smartly across different sectors and asset classes to minimize risks and optimize returns.

- Continuous Learning: Stay updated on market trends, investment opportunities, and financial strategies to make informed decisions and adapt to changing environments.

- Professional Advice: Consult financial advisors, tax experts, and investment professionals to receive tailored guidance and insights for strategic wealth management.

- Networking: Build connections within diverse industries and sectors to explore new opportunities, collaborations, and mentorship avenues.

- Long-Term Vision: Develop a clear financial plan and goals, aligning short-term actions with long-term objectives to sustain growth and stability.

FAQs (Frequently Asked Questions)

- How can I start diversifying my income streams in the Octopus Class Economy?

-

Begin by assessing your current sources of income and exploring additional avenues such as side hustles, investments, or rental properties.

-

Is it necessary to have multiple income streams to be part of the Octopus Class Economy?

-

While diversification is a key characteristic, having multiple streams of income is not a strict requirement. The focus is on cultivating resilience and growth through strategic financial decisions.

-

What are some common mistakes to avoid in navigating the Octopus Class Economy?

-

Avoid overextending your resources, neglecting risk management, or lacking a clear financial plan. Balancing diversification with focus is essential.

-

How can I stay organized when managing multiple income sources?

-

Utilize financial tools, spreadsheets, or apps to track income, expenses, and investments. Set up a structured schedule for monitoring and reviewing your financial portfolio regularly.

-

Are there specific industries or investments more suited for the Octopus Class Economy?

- The suitability of industries or investments varies based on individual risk tolerance, market knowledge, and financial goals. Research and seek advice to identify opportunities aligned with your preferences and objectives.

In conclusion, the Octopus Class Economy offers a unique framework for financial success, emphasizing diversification, resilience, and opportunity exploration. By understanding its intricacies, leveraging its benefits, and addressing its challenges proactively, individuals can navigate this dynamic economic landscape with confidence and strategic acumen. Embrace the versatility and adaptability of the Octopus Class Economy to chart a course towards sustainable wealth creation and prosperity.